Federal Personal Exemption 2025. One time (can carry it over) net metering: These exemptions can reduce the.

For 2025 (tax returns typically filed in april 2025), the standard deduction amounts are $13,850 for single and for those who are married, filing separately; This measure has received royal assent.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, There are seven federal tax brackets for tax year 2025. For 2025 (tax returns typically filed in april 2025), the standard deduction amounts are $13,850 for single and for those who are married, filing separately;

Discover The Latest Federal Estate Tax Exemption Increase For 2025, The irs has released the 2025 standard deduction amounts that you'll use for your 2025 tax return. The personal exemption for tax year 2025 remains at 0, as it was for 2025.

Claim for Exemption 20092024 Form Fill Out and Sign Printable PDF, It’s the simplest way to reduce your. There are seven federal tax brackets for tax year 2025.

Form W4 What It Is, Who Needs To File, and How To Fill It Out, The amt exemption for 2025 is $85,700 and begins phasing out at $609,350 ($133,300 for married couples filing jointly, phasing out beginning at $1,218,700). This measure has received royal assent.

Figuring Out Your Form W4 How Many Allonces Should You —, It is important to know the correct income tax rules for every. How have personal exemptions worked in the past?

:max_bytes(150000):strip_icc()/FormW-42022-92779be669a64b0da38ce644c949a9c6.jpeg)

FREE 10 Sample Tax Exemption Forms In PDF, In 2025, the amt exemption amount for married couples filing jointly is $133,300 and begins to phase out at $1,218,700 (in 2025, the exemption amount for. Federal bank after the revision offers fixed deposit interest rates between 3% to 7.75% for general citizens on tenure ranging from 7 days to 10 years.

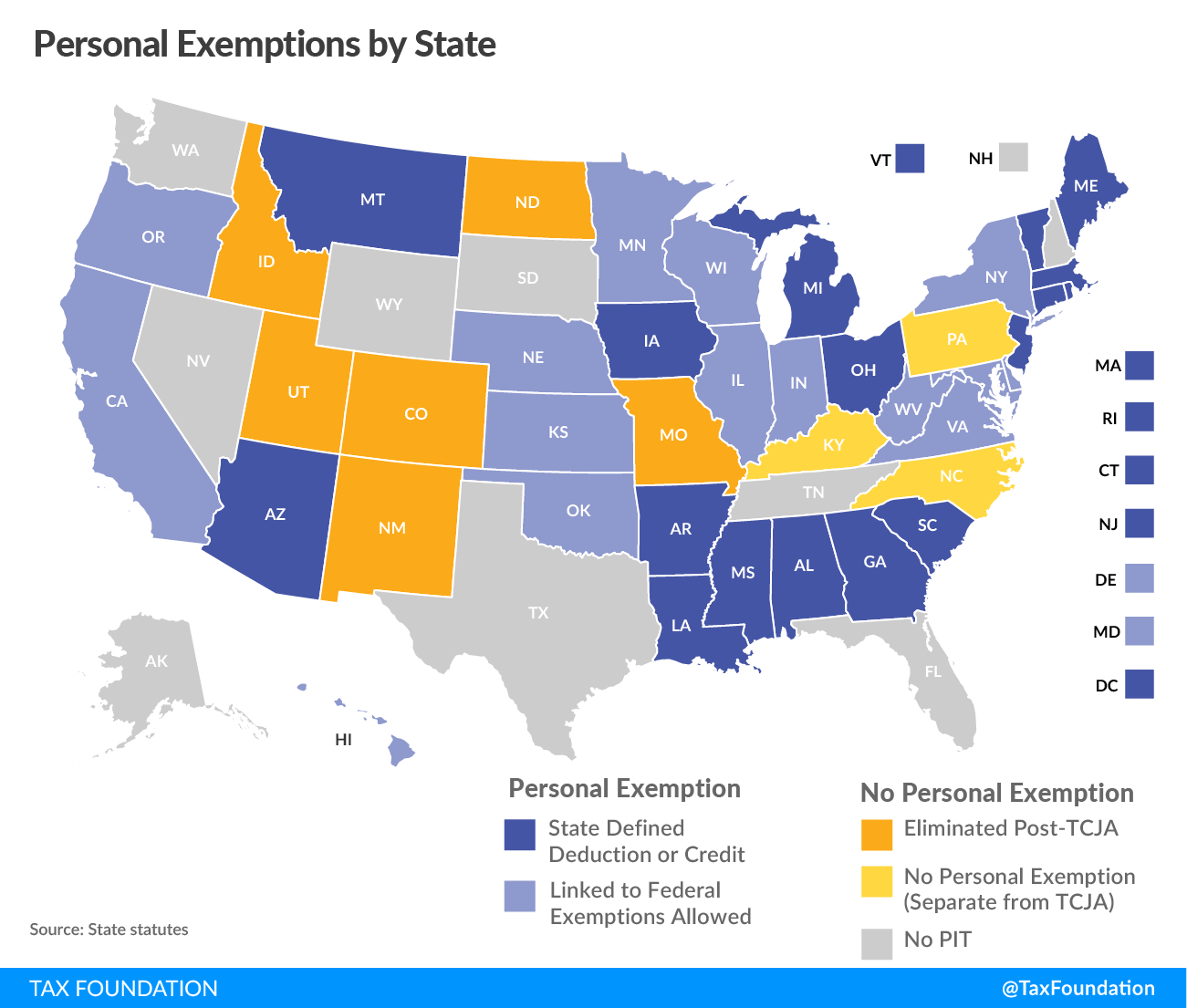

The Status of State Personal Exemptions a Year After Federal Tax Reform, During recent years, mobility has been a hot topic on the agenda of most organizations, as well as of the belgian legislature. People should understand which credits and deductions they.

W4 Exemptions 2025 W4 Forms, One time (can carry it over) net metering: New year, new tax measures — what to expect in 2025.

Form 2350 Fill out & sign online DocHub, What is the personal exemption for 2025? The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2).

Tax exempt form Fill out & sign online DocHub, How have personal exemptions worked in the past? 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

The irs has announced that for 2025, the federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person.